Share Price Behavior and Buyback Announcements by Listed Companies- An Evidence from the Indian Stock Market

DOI:

https://doi.org/10.5281/zenodo.18125901Keywords:

event study methodology, nifty 50, average abnormal return (AAR), cumulative average abnormal return (CAAR), ordinary least square regression modelAbstract

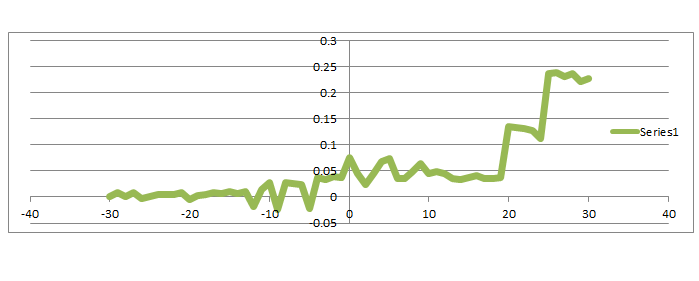

Buyback announcement is considered as the prominent announcement made by corporate houses. Many companies have announced the stock buyback in India. Share buybacks have progressively been examined as a key concern in financial study which is seeing as a strong implication in formulating corporate policy. Share buyback provide enough signaling ability to affect the share prices all over the world. The present research is an effort to examine the share price movement before and after the buyback repurchase through the open market mechanism for a sample of 46 companies made during the April 2015 to March 2022. The present manuscript uses the Ordinary Least square (OLS) regression to find out the alpha and beta values which is further use to arrive at the average abnormal return (AAR), cumulative abnormal return (CAR) and cumulative average abnormal return (CAAR). The present effort employs the Nifty 50 as a benchmark for the market model to anticipate the expected return of the sample companies. An estimation window of 200 trading days (ranging from day –230 to day –30) and an event window of 61 trading days (spanning from day –30 to day +30, including the event day) have been used to derive the results. The study reports that AAR on the declaration date is 1.09 percent and Cumulative average abnormal return (CAAR) is 7.53 percent for 61 days’ event window. As a result of analysis of buyback announcements in India shows that there is greater degree of signaling ability and it can help in accumulating the wealth for the shareholders.

Downloads

References

Rajlaxmi. (2013). Share buybacks – An analytical study of announcement effect on stock prices in India. Indian Journal of Applied Research, 3(2), 241-243.

P. Thirumalvalavan, & Sunitha K. (2006) Price behavior around buyback and dividend announcements in India. Indian Institution Capital Markets, 9th Capital Markets Conference Paper.

Kahle, K.M. (2002). When a Buyback isn’t a buyback: Open market repurchases and employee options. Journal of Financial Economics (63), 235-261.

Hyderabad, L.R. (2009) Price performance following share buyback announcements in India. VISION – The Journal of Business Perspective, 13(1).

Asquith, P., & Mullins, D. W., (1986) Signaling with dividends, stock repurchases and equity issues. Blackwell Publishing, pp. 27-44.

Chavali,K.,& S.Shemeem.(2011). Impact of buybacks on share price performance of companies in Indian context. European Journal of Finance and Banking Research, 4(4), 23-33.

Mishra. (2002). An empirical analysis of share buybacks in India. The ICFAI Journal of

Applied Finance, 11(4), 7-24.

P. Ishwar. (2010), Stock price responses to the announcement of buyback of shares in India. Indian Journal of Commerce and Management Studies, 163(1).

Grullon, G., & Michaely, R. (2004). The information content of share repurchases programs. The Journal of Finance, 59(2).

Isagawa, N. (2000). Open-market stock-repurchase and stock price behavior when management values real investment. Eastern Finance Association Review, 35, 95-108.

Raja, M., & Sudhahar clement, J., (2010). An empirical test of Indian stock market efficiency in respect of bonus announcement. Asia Pacific Journal of Finance and Banking Research, 4(4).

Neket, K., & Nippel, P. (2006). The impact of a firm’s payout policy on stock prices and shareholder wealth in an inefficient market. Econstor Journal of Economics, 619.

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Rajesh Kumar, Jyoti Madan, Mohit Kumar

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.