ARIMA-Based Forecasting of S&P BSE SENSEX Returns

DOI:

https://doi.org/10.54741/mjar.3.6.1Keywords:

arima, forecasting, s&p bse sensexAbstract

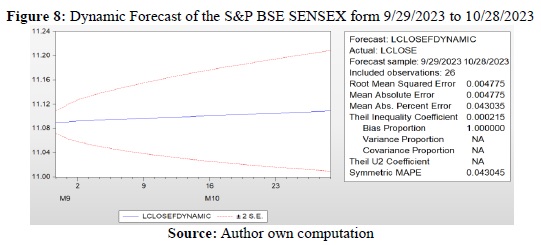

Investment in the stock market requires a delicate balance between profitability and risk management, with risk aversion playing a vital role. This study explores the ARIMA forecasting method to predict S&P BSE SENSEX returns, providing valuable insights for investors and financial experts. Using a 3-year dataset, the ARIMA (3,1,1) model was identified as the optimal choice. Diagnostic checks confirmed its reliability, ensuring unbiased and accurate forecasts. In static forecasting, the model exhibited high-quality performance with low error rates. Dynamic forecasting further revealed precision in predicting future values. While the ARIMA model aids in making informed financial decisions, it's crucial to acknowledge its limitations. This research contributes to the understanding of stock market forecasting methodologies, benefiting investors and analysts in navigating this dynamic landscape.

Downloads

References

Chari, A., & Henry, P. B. (2004). Risk sharing and asset prices: Evidence from a natural experiment. The Journal of Finance, 59(3), 1295–1324. Available at: https://doi.org/10.1111/j.1540-6261.2004.00663.x.

Guptha, S. K., & Rao, R. P. (2018). The causal relationship between financial development and economic growth: An experience with BRICS economies. SpringerLink. J Soc Econ Dev, 20(2), 308–326. Available at: https://doi.org/10.1007/s40847-018-0071-5.

Jiahan, L., & Ilias, T. (2017). Equity premium prediction: The role of economic and statistical constraints. Journal of Financial Markets, 36(C), 56–75. Available at: https://doi.org/10.1016/j.finmar.2016.09.001.

Kaufman, G. G. (1995). Comment on systemic risk. Research in Financial Services: Banking, Financial Markets, and Systemic Risk, 7, 47–52.

Kim, J., Lim, K., & Shamsuddin, A. (2011). Stock return predictability and the adaptive markets hypothesis: Evidence from century-long U.S. data. Journal of Empirical Finance, 18(5), 868–879. Available at: https://doi.org/10.1016/j.jempfin.2011.08.002.

Mallikarjuna, M., & Rao, R. P. (2019). Evaluation of forecasting methods from selected stock market returns. Finance Innov, 5(40). Available at: https://doi.org/10.1186/s40854-019-0157-x.

Neely, C. J., Rapach, D. E., Tu, J., & Zhou, G. (2014). Forecasting the equity risk premium: The role of technical indicators. Management Science, 60(7), 1772–1791. Available at: https://doi.org/10.1287/mnsc.2013.1838.

Zhu, X., & Zhu, J. (2013). Predicting stock returns: A regime-switching combination approach and economic links. Journal of Banking & Finance, 37(11), 4120–4133. Available at: https://doi.org/10.1016/j.jbankfin.2013.07.016.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Deep Dutta

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.