An Empirical Analysis of Performance and Evaluation of Mutual Funds in India

DOI:

https://doi.org/10.54741/mjar.3.4.5Keywords:

mutual fund, economy, investing, variety, financial products, taxesAbstract

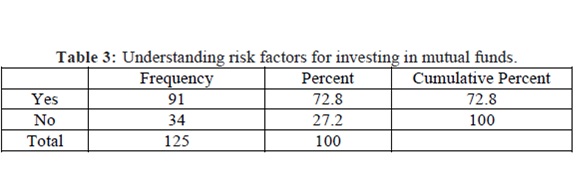

The mutual fund sectors are one of the fastest growing sectors in Indian Economy and have awesome potential for sustained future growth. Mutual funds make saving and investing simple, accessible, and affordable. The advantages of mutual funds include professional management, diversification, variety, liquidity, affordability, convenience, and ease of recordkeeping—as well as strict government regulation and full disclosure. Financial markets are becoming more extensive with wide-ranging financial products trying innovations in designing mutual funds portfolio but these changes need unification in correspondence with investor’s expectations. Thus, it has become imperative to study mutual funds from a different angle, which is to focus on investor’s perception and expectations. This research paper focused attention on number of factors that highlights investors’ perception about mutual funds. It was found that mutual funds were not that much known to investors, still investor rely upon bank and post office deposits, most of the investor used to invest in mutual fund for not more than 3 years and they used to quit from the fund which were not giving desired results. Equity option and SIP mode of investment were on top priority in investors’ list. It was also found that maximum number of investors did not analyze risk in their investment and they were depend upon their broker and agent for this work.

Downloads

References

Ganesan S, & Raja J. (2000). Mutual funds, the millennium strategy. The Journal of the All India Management Association, 39(10), 42-47.

http://www.amfiindia.com/spages/aqu-vol10 issueIV.pdf.

Atmaramani K. N. (2001). Mutual Funds: The best avenue for investment. Chartered Secretary, 31(1), 9-11.

Mehta, Rajan. (2003). Indian mutual fund industry: Challenging issues. Chartered Financial Analyst, 9, 32-33.

http://www.amfiindia.com/spages/aqu-vol11-issueI.pdf.

Salam Abdus., & Kulsum, Umma. (2003). Savings behaviour in India: An empirical study. The Indian Economic Journal, 50(1), 77-80.

http://rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=26310.

Rajarajan (2003). Determinants of Portfolio choice of Individual Investors. The Indian Economic Journal, 50(1), 81-84.

Banerjee, Arindam. (2006). Mutual funds: Wealth Creation through Systematic Investment Plans. ICFAI Portfolio Organiser, pp.53-58.

http://www.mutualfundsindia.com/Assets%20_under%20_Management.asp.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Amit Kumar Sharma

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.