Fiscal Deficit and Taxes in India: Some Observations

DOI:

https://doi.org/10.54741/mjar.3.3.6Keywords:

direct taxes, indirect taxes, gross fiscal deficit, debt management, gross domestic productsAbstract

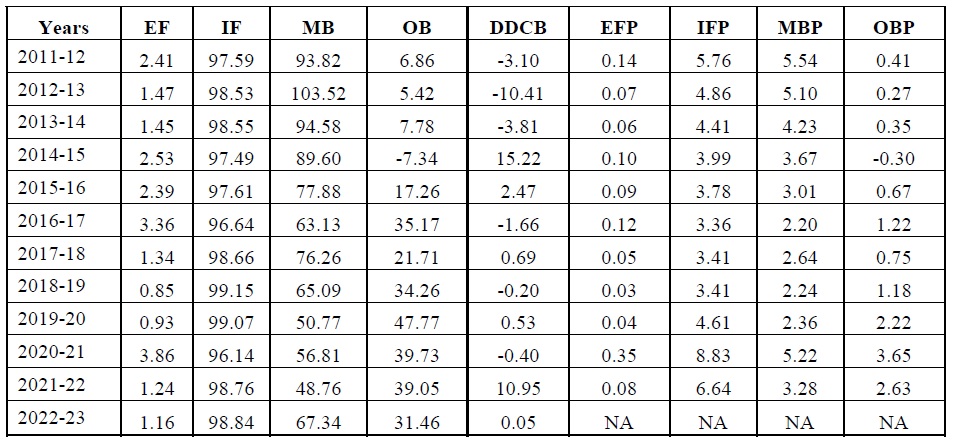

The national and international evidences suggest that the government projects, and production activities have not been producing considerable returns and profits even to take care of opportunity costs. The attempt in this study is not to focus analytically into public expenditure but delve into some of the important elements and considerations which shaped policy concerns for taxation and their subsequent implications on fiscal deficits and borrowings. Considering the nature of exposition organised in this study, an exploratory analysis is adopted from the viewpoints of expressing critical opinions which are based on existing information and overall fiscal scenario by taking into account of inflation, financial markets, public debt management and economic growth. The behaviour of centre’s direct tax has direct impact on trend of the combined direct tax, but evidently indirect tax of the centre has not produced any significant impact on combined indirect tax due to the fact states’ indirect taxes have been reasonably and strongly stable even when economic growth rate slipped during COVID-19. Gross Fiscal Deficit and revenue deficit are moving in tandem, and this importantly means unless a significant decrease in revenue expenditures is brought down in the form of decline in the current expenditure, the fiscal prudency in bringing the fiscal deficit below the three percent of Gross Domestic Products (GDP) is extremely difficult exercise. The market borrowing as a critical and pre-dominant source of deficit financing has created dynamic changes in both money markets and capital markets. Along with financial deepening, integration of government securities and treasury bills play an important role in deciding particularly short-term financial rates by giving greater substitutability and greater return with almost no risk. The scenario narrated on taxes and borrowing could well produce some mixed implications for macro management and financial sectors. Government should look forward for correcting their fiscal course at least in terms of bringing fiscal deficit closer to the sustainable level while making taxes to strengthen market mechanism.

Downloads

References

Abizadeh, S. (1979). Tax ratio and the degree of economic development. Malayan Economic Review, 24, 21–34.

Abizadeh, S., & Gray, J. A. (1992). Politics and provincial government spending in Canada. Canadian Public Administration, 35, 519–33.

Chelliah, R. J. (1975). Tax ratios and tax effort in developing countries, 1969-71. IMF Staff Papers, 22, 187–205.

Chelliah, R. J. (1989). Changes in tax revenue structure: a case study of India. in Changes in Revenue Structures: Proceedings of the 42nd Congress of the International Institute of Public Finance (Eds) A. Chiancone and K. Messere, Wayne State University Press, Athens, pp. 153–65.

Chittenden, F., Hall, G., & Hutchinson, P. (1996). Small firm growth, access to capital markets and financial structure: review of issues and an empirical investigation. Small Business Economics, 8(1), 59-67.

Conte, M. A., & Darrat, A. F. (1988). Economic growth and expanding public sector: A re-examination. Review of Economics and Statistics, 70, 322–30.

Easterly, W., & Rebelo, S. (1993). Fiscal policy and economic growth. Journal of Monetary Economics, 32, 417–58.

Engen, E. M., & Skinner, J. (1999). Taxation and economic growth. in Tax Policy in the Real World(Ed.) J. Slemrod, Cambridge University Press, New York, pp. 305–30.

Fama, E.F., & French, K.R. (1998). Taxes, financing decisions, and firm value. Journal of Finance, 53, 819-43.

Gerson, P. (1998). The impact of fiscal policy variables on output growth. IMF Working Paper 98/1, International Monetary Fund, Washington DC.

Graham, J.R. (2000). How big are the tax benefits of debt?. Journal of Finance, 55, 1901-41.

Groves, H. M., & Kahn, C. H. (1952). The stability of state and local tax yields. American Economic Review, 42, 87–102.

Jensen, M., & Meckling, W. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305-60.

Jones, J. D., & Joulfaian, D. (1991). Federal government expenditures and revenues in the early years of the American Republic: evidence from 1792 to 1860. Journal of Macroeconomics, 13, 133–55.

Joulfaian, D., & Mookerjee, R. (1990). The intertemporal relationship between state and local government revenues and expenditures: evidence from OECD Countries. Public Finance, 45, 109–17.

Joulfaian, D., & Mookerjee, R. (1991). Dynamics of government revenues and expenditures in industrial economies. Applied Economics, 23, 1839–44.

King, R. G., & Rebelo, S. (1990). Public policy and economic growth: developing neoclassical implications. Journal of Political Economy, 98, S126–50.

Martin, A., & Lewis, W. A. (1956). Patterns of public revenue and expenditure. The Manchester School of Economic and Social Studies, 24, 203–44.

Messere, K. (1998). The tax system in industrialized countries. in The Tax System in Industrialized Countries (Ed.) K. Merssere, Oxford University Press, New York, pp. 1–38.

Messere, K. (1999). Half a century of changes in taxation. Bulletin for International Fiscal Documentation, 53, 340–65.

Miller, M.H. (1977). Debt and taxes. Journal of Finance, 32, 261-76.

Volkerink, B., & De Haan, J. (1999). Political and institutional determinants of the tax mix: an empirical investigation for OECD countries, SOM Research Report, 99E05. University of Groningen, Groningen.

Winer, S. L., & Hettich, W. (1998). What is missed if we leave out collective choice in the analysis of taxation. National Tax Journal, 52, 373–89.

World Bank. (2002). World development indicators. World Bank, Washington, DC.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Dr. Mitulkumar T. Parmar

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.