An Investigation into India's Online Trading System

DOI:

https://doi.org/10.54741/mjar.3.3.3Keywords:

trading, business, stock market, privatization, economic growthAbstract

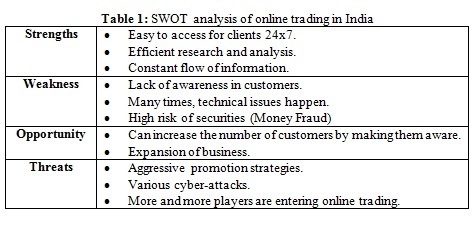

This study explores the new trend in online trading in relation to businesses and brokerages. One of the key components of the Indian economy that affects the nation's financial health and rate of economic growth is the stock market. In the modern world, there are millions of internet users, many of whom come from rural backgrounds. GPL (Globalization, Privatization, and Liberalization) and the internet have had a significant impact on people's views during the past 30 years, starting in 1991. The sole factor determining a company's success is client pleasure. The goal of the current study is to determine consumer knowledge of internet trading. The study's primary goal is to comprehend how internet trading functions. The main justification for investing in the stock market is compelling and simple to understand.

This publication is open access (OA), and all articles are distributed under the Creative Commons Attribution-NonCommercial-ShareAlike 4.0 License, which permits others to remix, modify, and build upon the work in noncommercial ways as long as proper attribution is given and the new works are licensed in accordance with the same terms.

Downloads

References

Agnew, J., P. Balduzzi, & A. Sunden. (2003). Portfolio choice and trading in a large 401(K) plan. American Economic Review, 93(1), 193-215.

https://scholar.google.com/citations.

Walia N., & Kumar R. (2007). Online stock trading in India: An empirical investigation. Indian Journal at Marketing 37.

N.Y. Oh, J.T. Parwada., & T.S. Walter. (2008). Investors’ trading behavior and performance: Online versus non-online equity trading in Korea. Pacific-Basin Finance Journal, 16(1), 26–43.

https://acsjournals.onlinelibrary.wiley.com/doi/abs.

R. Parkash, M. Awais., & U.A. Warraich. (2014). Do socio-economic factors really influence risk taking behavior of individual investors?. Research Journal of Management Sciences, 3(6), 10-13.

Bade A. (2017). Analysis demat account and online trading. Sch Res J, 4(30), 4921–4.

Sandeep Sharma. (2021). A study of online trading system in India. Journal of Management Research and Analysis, 8(3), 139-142.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Shailesh Kumar, Amit Singh

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.