Buyers’ Perception towards Life Insurance Policies Offered in Insurance Industry: A Study

DOI:

https://doi.org/10.54741/mjar.3.2.2Keywords:

awareness, literacy, information, knowledge, viewsAbstract

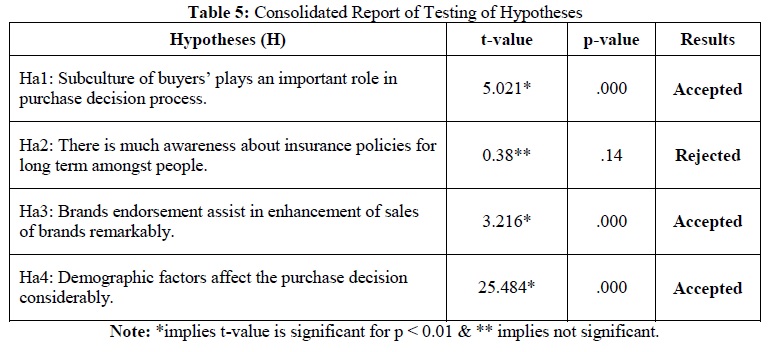

The aim of this paper is to examine the buyers’ perception towards life insurance policies offered by the public and the private sector organizations while focusing on some important factors viz. knowledge, information, awareness, literacy and views about life insurance policies among buyers. This paper is an attempt to investigate the overall perception of the life insurance buyers targeting pre and post buying behavior. This research study was surveyed on a variety of buyers of Indore city (Madhya Pradesh) based on various demographic factors. The research findings revealed that still people do not pay due importance to life insurance policy, they prefer other financial instruments, such as- bank deposit, mutual funds, stock market and some others. The study also found that the policies which are propagated by agents, and endorsed by organizations, have been in higher demand. The buyers treated life insurance as an investment and tax saving instrument instead of risk coverage instrument. The buyers have less knowledge, information and literacy about life insurance. The views of illiterate people were not contingent due to technical issues such as, physical absence of inquirers, language problem, pre-inquiry orientation, etc. If those were contingent to admit, the result would have been more valuable.

Downloads

References

Anderson J., & Brown, R. (2005). Risk and insurance. USA: Society of Actuaries.

Arrow, K.. (1970). Essays in the theory of risk –Bearing. Amsterdam and London: North Holland Publishing Company, pp. 137.

BarNiv, R., & J. B. McDonald. (1992). Identifying financial distress in the insurance industry: A synthesis of methodological and empirical issues. Journal of Risk and Insurance, 59, 543-574.

BarNiv, R., & M. L Smith. (1987). Underwriting, investment and solvency. Journal of Insurance Regulation, 5, 409-428.

Bodla B. S., M. C. Garg, & K. P. Singh. (2003). Insurance fundamentals, environment and procedures. Deep & Deep Publications Pvt. Ltd.

Chiappori, P. A., & B. Salanie. (2002). Testing contract theory: A survey of some recent work. Advances in Economics and Econometrics, M. Dewatripont, L. Hansen and S. Turnovskyeds, Cambridge University Press.

Hofstede, G. (1995). “Insurance as a product of national values. Geneva Papers on Risk and Insurance, 20(4), 423–29.172

Malhotra Committee Report on Reforms in the Insurance Sector. (1994). Government of India, Ministry of Finance, New Delhi.

Rees, R., & Kessner, E. (1999). European insurance markets, regulation and efficiency. Economic Policy, 29, 363–397.

Skipper, Harold D., Jr. (1997). Protectionism in the provision of international insurance service. The Journal of Risk and Journal.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Dr. R. K. Ghai, Dr. Dolly Vaish

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.