Assessing the Outcome of Demographic Variables on the Saving Determinants and Saving Behaviour of the Individuals of Ludhiana

DOI:

https://doi.org/10.54741/mjar.3.1.7Keywords:

saving determinants, saving behaviour, demographic factors, ludhianaAbstract

Purpose: The major purpose of the study relates to assessing the impact of different demographic factors on the saving determinants and saving behaviour of the individuals of Ludhiana. Therefore, in this study saving determinants and behaviour were considered as dependent variable and the demographic variables as independent variable.

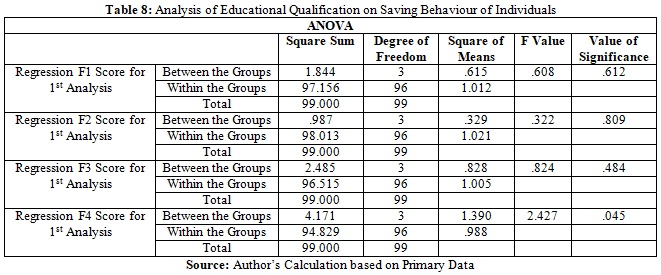

Design, Methodology & Approach: The data was collected from 100 respondents which comprised of individuals representing different heterogeneities of Ludhiana. The tools of Factor Analysis, Independent T-test and One Way ANOVA were applied to study the impact of five demographic variables on the saving determinants and behaviour on the individuals of Ludhiana.

Findings: The studies revealed that certain factors of saving behaviour had an insignificant relationship with the demographic factors while virtuous considerations and financial considerations resonated a significant impact with certain demographic factors.

Research Limitations: The major limitation of the study was that the sample was relatively of a smaller size. Had it been of a larger size, the results would have been an accurate one.

Originality/Value: This paper was a first in its kind to study the saving behaviour of the Individuals of Ludhiana on the basis of their demographic factors.

Downloads

References

Amari, M., Salhi, B., & Jarboui, A. (2020). Evaluating the effects of sociodemographic characteristics and financial education on saving behavior. International Journal of Sociology and Social Policy, 40(11–12), 1423-1438. doi:10.1108/IJSSP-03-2020-0048.

Amer Azlan, A. J., Wijaya, K. R., Rosle, M., & Zaiton, O. (2016). Determinants of savings behaviour among university students in Sabah, Malaysia. International Journal of Accounting, Finance and Business, 1(1), 24–37.

Aranjan Pandu, G., & R, S. (2019). Relationship between savings determinants and savings behaviour among households in tamil nadu and puducherry. Available at: http://publishingindia.com/jcar/.

Baidoo, S. T., Boateng, E., & Amponsah, M. (2018). Understanding the determinants of saving in Ghana: Does financial literacy matter?. Journal of International Development, 30(5), 886–903. doi: 10.1002/jid.3377.

Brown, S., & Taylor, K. (2016). Early influences on saving behaviour: Analysis of British panel data. Journal of Banking and Finance, 62(September), 1–14. doi: 10.1016/j.jbankfin.2015.09.011.

Fuchs-Schündeln, N., Masella, P., & Paule-Paludkiewicz, H. (2020). Cultural determinants of household saving behavior. Journal of Money, Credit and Banking, 52(5), 1035–1070. doi: 10.1111/jmcb.12659.

Gatt, W. (2014). The determinants of household saving behaviour in Malta. 1–21.

Grigoli, F., Herman, A., & Schmidt-Hebbel, K. (2018). Saving in the world. World Development, 104, 257–270. doi: 10.1016/j.worlddev.2017.11.022.

Helmi Hashim, J., Qimah Al Mudhafah, A., Bt Kamarudin, Z., & Kangsar Perak MALAYSIA, K. (2018). Factors affecting the saving behaviour of taj international college students. The Journal of Management and Science (ALQIMAH), 4(1), 1–15. Available at: https://www.researchgate.net/publication/330425997.

Kusairi, S., Sanusi, N. A., Muhamad, S., Shukri, M., & Zamri, N. (2019). Financial households’ efficacy, risk preference and saving behaviour: Lessons from lower-income households in Malaysia. Economics and Sociology, 12(2), 301–318. doi: 10.14254/2071-789X.2019/12-2/18.

Magendans, J., Gutteling, J. M., & Zebel, S. (2017). Psychological determinants of financial buffer saving: the influence of financial risk tolerance and regulatory focus. Journal of Risk Research, 20(8), 1076–1093. doi: 10.1080/13669877.2016.1147491.

Ming Thung, C., Ying Kai, C., Sheng Nie, F., Wan Chiun, L., & Chang Tsen, T. (2012). Determinants of saving behaviour among the university students in Malaysia. Universiti Tunku Abdul Rahman, May, 109. Available at: http://eprints.utar.edu.my/607/1/AC-2011-0907445.pdf.

Mohammed Esmail Alekam, J., Salniza Bt Md. Salleh, M., & Sanuri bin Mohd. Mokhtar, S. (2018). The effect of family, peer, behavior, saving and spending behavior on financial literacy among young generations. International Journal of Organizational Leadership, 7(3), 309–323. doi: 10.33844/ijol.2018.60258.

Murendo, C., & Mutsonziwa, K. (2017). Financial literacy and savings decisions by adult financial consumers in Zimbabwe. International Journal of Consumer Studies, 41(1), 95–103. doi: 10.1111/ijcs.12318.

Nyhus, E. K., & Webley, P. (2001). The role of personality in household saving and borrowing behaviour. European Journal of Personality, 15(1 SUPPL.). doi: 10.1002/per.422.

Opoku, P. K. (2020). The short-run and long-run determinants of household saving: evidence from OECD economies. in Comparative Economic Studies, 62(3). Palgrave Macmillan UK. doi: 10.1057/s41294-020-00123-2.

Rengarajan, V., Sankararaman, G., Kalyana Sundaram, M., Mohamed Rizwan, M., & Mathew Paul Nibin, S. (2016). Influence of demographic variables on saving behaviour of rural households - A study with reference to Sriperumpudur, Chennai. Indian Journal of Science and Technology, 9(31). doi: 10.17485/ijst/2016/v9i31/97606.

Satsios, N., & Hadjidakis, S. (2018). Applying the Theory of Planned Behaviour (TPB) in saving behaviour of Pomak households. International Journal of Financial Research, 9(2), 122–133. doi: 10.5430/ijfr.v9n2p122.

Snyder, D. W. (1974). Econometric studies of household saving behaviour in developing countries: A survey. The Journal of Development Studies, 10(2), 139–153. doi: 10.1080/00220387408421481.

Wubie, A. W., Dibabe, T. M., & Wondmagegn, G. A. (2015). The influence of demographic factors on saving and investment decision of high school teachers in Ethiopia: A case study on dangila woreda. Research Journal of Finance and Accounting, 6(9), 64–69.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Gaurav K. Mangar, Sakshi Sardana, Dr. Monika Hanspal

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.