Performance of Mutual Funds in India: A Study with Reference to Select Equity Multi-Cap Funds

DOI:

https://doi.org/10.54741/mjar.3.1.2Keywords:

aum, covid-19, equity multi-cap fund, mutual fundAbstract

Indian Mutual Fund Industry has witnessed enormous expansion in terms of growth of Assets under Management (AUM), from a meagre Rs. 25 crores in 1964 to Rs. 36.59 lakh crores in August 2021. Equity Multi-cap mutual funds tend to invest in stocks of companies across the stock market irrespective of sector and size. As a result, these funds provide much-needed diversification. In a direct plan, the investor decides to invest directly in mutual funds without routing the investment through any distributor or agent. Due to the absence of an intermediary commission, the direct plan has a lower expense ratio than a regular plan which leads to higher returns.

Since the outbreak of COVID-19, the stock markets have experienced an extensive crisis with severe dampening effects in the entire global scenario. It has affected the Indian Mutual Fund Industry as well. However, irrespective of all negative signs, the impact of COVID-19 has created a ray of hope towards rebuilding self-confidence for Indian investors during the last year in this new normal landscape.

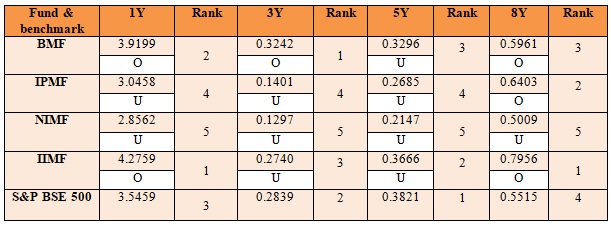

In this backdrop, the present research paper focuses on examining the performance of direct plans of four open-ended Equity Multi-cap Mutual Funds [Baroda Multi-Cap Fund (BMF), ICICI Prudential Multi-Cap Fund (IPMF), Invesco India Multi-Cap Fund (IIMF) and Nippon India Multi-Cap Fund (NIMF)] based on certain parameters. This secondary data-based study covers 8 years (2013-2021). The criterion for selecting the funds was net assets above Rs.1,000 crores as of 31.08.2021. Results reveal that the funds provided double-digit returns during the entire study period. IPMF and NIMF performed poorly and remained riskier than the benchmark during the entire study period. Further, NIMF remained the riskiest fund throughout the study period. IIMF remained the best performer in the 1-year, 5-year and 8-year periods in terms of risk-adjusted return. NIMF remained the most aggressive fund and BMF remained the most defensive fund during the entire study period. The fund managers of IIMF succeeded in quality stock-picking in 1-year, 5-year and 8-year. The fund managers of NIMF performed miserably throughout the study period and failed in quality stock picking. RSQ values portray that BMF was the most successful fund in terms of diversification during the entire study period.

Downloads

References

Badrinath, R. (2008). Contra fund in India: A quick look. Portfolio Organiser, 31-34.

Bandyopadhyay, S. (2008, December 08). No place ELSS.

Chandrakumarmangalam, S., & Govindasamy, P. (2011). Study on ELSS fund & its performance analysis with reference to karvy stock broking ltd. International Journal of Human Resource Management and Research, 01(02), 43-61.

Goyal. (2015). Performance evaluation of top 10 mutual funds in India. Indian Journal of Commerce and Management Studies, 06(01), 51-55.

Kamboj, D., & Jagotra, S. (2018). An empirical study on the performance of select multicap equity mutual funds in India. MUDRA Journal of Finance and Accounting, 04(02).

Kaushik, A. (2019). Performance evaluation of mid-cap retail equity mutual funds. International Journal of Finance and Banking Studies, 08(02).

Loomba, J. (2011). Investigating performance of equity-based mutual fund schemes and comparison with indian equity market. Asian Journal of Research in Banking and Finance .

Roy, S., & Ghosh, S. (2010). Diversification as a measure of mutual fund performance: An empirical study of the open-ended mutual fund schemes in India. Annamalai International Journal of Business Studies & Research, 02(01), 1-15.

Shin, S., & Soydemir, G. (2010). Exchange-traded funds, persistence in tracking errors and information dissemination. Journal of Multinational Financial Management, 20(4-5).

Shitole, G., & Thyagarajan, G. (2012). Performance evaluation of mutual funds in India. New Delhi: Adhyayan Publishers and Distributors .

Srivastava, N. (2014). Performance indicators of Equity linked saving schemes in India: An empirical Analysis. International Journal for Research in Applied Science and Engineering Technology (IJRASET), 02(03), 244-250.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Sourav Kumar Das, Dr. Samyabrata Das, Dr. Samarpita Seth

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.