Performance Analysis of Select ESG Funds in India

DOI:

https://doi.org/10.54741/mjar.3.1.1Keywords:

esg, return, risk, sustainabilityAbstract

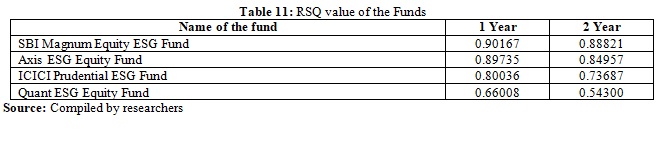

The creation of the “Jones Sustainability Index” in 1999, the “Asia Pacific Index” in 2009 and other indices have made it easier for investors to select companies with a best-in-class approach to ‘economic’, ‘environmental’ and ‘social issues’(ESG). ESG investing is now percolating in response to public demand for ESG investment products and the adoption of ESG by mainstream investors in the West. In line with “United Nation Environmental Programme (UNEP)” in 2014, the Indian government started the process of inducting Sustainable Finance schemes in the Green energy, non-renewable energy, technology hardware, and renewable energy sector mainly through startups in the form of Business Loans to MSME sector by various lending institutions. In this research paper, an attempt has been made to analyse the performance of select ESG for 24 months after the outbreak of Covid-19 based on return and risk evaluation. This secondary data-based analysis includes four ESG funds and uses tools like ‘Compound Annual Growth Rate (CAGR)’, ‘Standard Deviation’, ‘Sharpe Ratio’, ‘Treynor Ratio’, ‘Alpha’, ‘Beta’ and ‘coefficient of determination’. The study expects to benefit the stakeholders in choosing appropriate ESG scheme. In terms of ‘CAGR’, ‘Sharpe Ratio’ and ‘Treynor Ratio’ most of the funds have underperformed. Most of the funds are defensive during both time frames. For the entire time the degree of diversification is quite satisfactory for most of the funds.

Downloads

References

Ashwin Kumar, N. C., Smith, C., Badis, L., Wang, N., Ambrosy, P., & Tavares, R. (2016). ESG factors and risk-adjusted performance: A new quantitative model. Journal of Sustainable Finance & Investment, 6(4), 292-300.

Bhatia Aparna, & Tulisiya. (2017). Sustainability reporting under G3 guidelines: A study on constituents of bovespa index. Vision: The Journal of Business Perspective, 21(2), 204-213.

Caesaria Farisa Aisyah, & Basuki B. (2017). The study of sustainability report disclosure aspects and their impact on the companies’ performance. SHS Web Conf. (Sec. Management Accounting and Costing), 34, pp. 08001.

Curtis, Q., Fisch, J., & Robertson, A. Z. (2021). Do ESG mutual funds deliver on their promises?. Mich. L. Rev., 120, 393.

Ferriani, F., & Natoli, F. (2021). ESG risks in times of Covid-19. Applied Economics Letters, 28(18), 1537-1541.

Jin, I. (2018). Is ESG a systematic risk factor for US equity mutual funds?. Journal of Sustainable Finance & Investment, 8(1), 72-93.

Wimmer, M. (2013). ESG-persistence in socially responsible mutual funds. J. Mgmt. & Sustainability, 3, 9.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Abhishek Dutta, Baitali Paul

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.