Effect of Socio-Economic Factors on Tax Compliance of Commercial Tricycle Operators in Yobe State, Nigeria

DOI:

https://doi.org/10.5281/zenodo.17746463Keywords:

tax compliance, socio-economic factors, daily due, commercial tricycle operators, infrastructure developmentAbstract

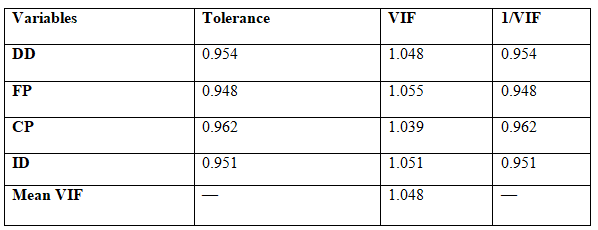

This study investigates the effect of socio-economic factors on tax compliance among commercial tricycle operators in Yobe State, Nigeria. The research was motivated by persistent non-compliance within the informal transport sector despite government efforts to enhance internally generated revenue through the introduction of daily dues. Using a survey research design, data were collected from 385 tricycle operators selected from a population of 22,541 registered with YOROTA. A structured questionnaire measured daily due, fairness in payment, cost of penalty, infrastructure development, and tax compliance using a five-point Likert scale. Cronbach’s Alpha confirmed strong internal consistency across study constructs. Descriptive statistics indicated strong agreement among respondents concerning the relevance of socio-economic factors. Correlation results revealed significant positive relationships between all predictors and tax compliance. Regression analysis further demonstrated that daily due, fairness in payment, cost of penalty, and infrastructure development jointly explained 81.4% of the variation in tax compliance. Daily due exerted the strongest positive influence, followed by fairness, penalty cost, and infrastructure development. These findings align with socio-economic compliance theories emphasizing the role of fairness perceptions, penalty enforcement, and public service delivery in shaping taxpayer behaviour. The study concludes that socio-economic factors are critical determinants of voluntary tax compliance among informal transport operators. It recommends improved taxpayer engagement, transparency in revenue utilization, and restructuring of daily dues to reflect operators' economic realities. Strengthening administrative efficiency and enhancing fairness may substantially boost compliance levels in the informal transportation sector.

Downloads

References

Adewale, T., & Abiola, R. (2024). Informal sector taxation and revenue mobilization in Nigeria. Journal of Public Finance Studies, 16(1), 44–59.

Afolabi, K., & Danjuma, M. (2023). Daily taxation and compliance behaviour of transport workers in Nigeria. African Journal of Taxation and Economic Policy, 8(2), 77–93.

Aladejebi, O. (2018). The impact of small scale businesses on the Nigerian economy. International Journal of Academic Research in Business and Social Sciences, 8(5), 1–11.

Antwi, S., Cao, Y., & Tony, S. (2015). Factors influencing tax compliance in developing countries. International Journal of Economics and Finance, 7(9), 1–15.

Carsamer, E., & Abbam, A. (2020). Religion and tax compliance among SMEs in Ghana. Journal of Accounting and Taxation, 12(2), 23–38.

Damayanti, T., & Supramono, S. (2021). Market competition fairness and tax compliance: Evidence from global survey data. Global Journal of Economics and Business, 12(4), 115–130.

Devos, K. (2010). Tax evasion and avoidance: Causes and consequences. Revenue Law Journal, 20(1), 1–30.

Dillman, D. (2007). Mail and Internet Surveys: The Tailored Design Method (2nd ed.). Wiley.

Dlamini, P. (2022). Determinants of tax compliance among SMEs in Durban. Southern African Journal of Entrepreneurship and Small Business Management, 14(1), 55–67.

Etim, R., Udo, U., & Udoh, A. (2020). Daily tax dues and informal sector compliance in Nigeria. Journal of Taxation and Economic Development, 19(3), 40–55.

Fagbeni, T., & Abogun, S. (2015). Taxpayer compliance in developing economies. Nigerian Journal of Accounting Research, 3(1), 15–29.

Farrar, J., & Thorne, L. (2018). Perceptions of tax fairness and compliance behaviour. Journal of Business Ethics, 149(1), 1–12.

Fors, F., & Kareholt, I. (2017). Socio-economic indicators and decision behavior. Journal of Behavioral Economics, 29(2), 87–101.

Graha, S. (2018). Tax fairness and tax compliance with trust as an intervening variable. Journal of Finance and Accounting, 10(6), 112–120.

Idowu, A., & Nguavese, M. (2018). Gender diversity and tax compliance in Lagos State. Nigerian Journal of Social Sciences, 14(2), 45–57.

Inegbedion, H. (2025). Measurement reliability in tax compliance research. Journal of Tax Administration, 11(1), 20–37.

Kagan, J. (2021). Understanding tax fairness. Journal of Economic Perspectives, 35(4), 122–135.

Kircher, E. (2007). Socio-economic drivers of tax compliance. Journal of Public Policy, 27(3), 221–238.

Loo, E. (2006). Tax knowledge and compliance among SMEs. Asian Review of Accounting, 14(2), 54–68.

Muharremi, F., & Hoxhaj, A. (2022). Demographics and ethics in tax compliance. Albanian Journal of Economics, 4(1), 77–95.

Mustapha, A., & Idris, S. (2024). Predictors of tax compliance in developing economies. International Journal of Fiscal Studies, 6(2), 33–49.

Oladipo, A., & Obazee, E. (2016). Penalties and tax evasion among SMEs. Journal of Accounting and Tax Research, 2(1), 91–105.

Oladipo, A., Salawu, R., & Tijani, A. (2022). Tax fairness, knowledge, and compliance in Nigeria. Journal of Contemporary Tax Studies, 8(1), 14–27.

Oluyombo, O., & Olayinka, M. (2018). Causes of tax non-compliance in Nigeria. International Journal of Accounting Research, 6(2), 85–100.

Osioma, E., & Okafor, F. (2024). Statistical reliability in tax compliance modelling. Journal of Quantitative Economics, 17(1), 99–115.

Oyeleke, T., & Sanni, M. (2023). Socio-economic determinants of transport sector tax compliance. West African Journal of Management Studies, 9(3), 55–70.

Palil, M. (2010). Tax knowledge and compliance determinants. International Journal of Economics and Finance, 2(2), 97–105.

Peter, O., & Sunday, B. (2017). Tax compliance challenges in developing nations. Journal of Economic Policy Studies, 4(1), 33–48.

Scholz, J., & Witte, A. (1989). Taxpayer compliance: An economic analysis. The American Economic Review, 79(2), 53–57.

Small and Medium Enterprises Development Agency of Nigeria. (2017). SME Development Survey Report. SMEDAN Publications.

Tadesse, M., & Goitom, A. (2014). Government spending perception and tax compliance. Journal of Economic and Financial Studies, 2(4), 10–20.

Tilahun, M. (2018). Social and economic determinants of voluntary compliance. Ethiopian Journal of Economic Studies, 6(2), 55–70.

Tilahun, M. (2021). Socio-economic indicators in informal sector tax studies. East African Journal of Economics, 12(3), 44–58.

Torgler, B. (2007). Tax compliance and social norms: A theoretical and empirical analysis. Edward Elgar.

Torgler, B., & Schneider, F. (2005). Rational tax evasion behaviour. Public Choice, 124(1–2), 119–138.

Umoffong, C., & Bassey, I. (2020). Socio-economic and individual factors affecting tax compliance. Nigerian Journal of Taxation, 11(1), 60–77.

Wenzel, M. (2005). Motivation and tax compliance in the informal sector. Journal of Economic Psychology, 26(4), 491–515.

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Usman Alhaji Audu, Kachalla Modu Kuru

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.