Contribution of All India Investment Institutions (LIC, UTI and GIC) in the Development Finance: Case of India

DOI:

https://doi.org/10.5281/zenodo.12890089Keywords:

all india investment institutions, lic, uti, gic, aifi, institutional investmentAbstract

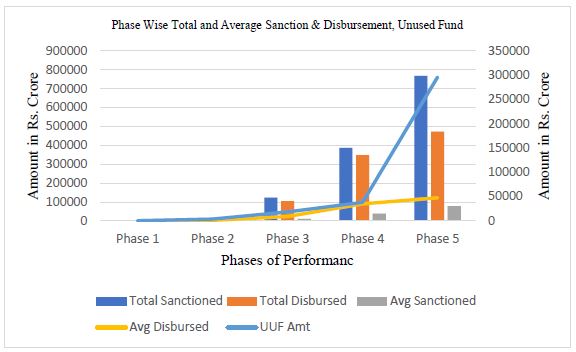

The paper examines the performance of All India Investment Institutions contributed to development finance from 1970 to 2022. The secondary data from IDBI Development Bank Report and RBI annual report is retrieved and analysed. Simple descriptive techniques are used in the analysis of assistance sanctioned and disbursed to obtain output. The trends of financial assistance sanctioned and disbursed, growth patterns of assistance sanctioned and disbursed, pattern of sanction-disbursement ratio, and unused funds of investment institutions are analysed. Life Insurance Corporation (LIC), Unit Trust of India (UTI) and General Insurance Corporation (GIC) have played important roles as an all-India investment institution. The result reflects that Unit Trust of India contributed fifty per cent of the total loan contribution followed by LIC till the financial year 2002-03. UTI stopped contribution from 2003-04, then the burden shifted to LIC and GIC. The LIC has been bearing the maximum burden of investment contribution from 2003-04 and has touched a hundred per cent. The GIC never touched the line of UTI and LIC, and since 2017-18 it has stopped investment contributions. Currently, only LIC is contributing to institutional investment for development projects as an All-India Investment Institution. Other investment firms of the government and private sector must take lessons from the successful journey of LIC on one side, and understand the causes of the UTI crisis on the other side.

Downloads

References

Agarwal, P. K., & Pradhan, H. K. (2018). Mutual fund performance using unconditional multifactor models: Evidence from India. Journal of Emerging Market Finance, 17(2). doi:10.1177/0972652718777056. Available at: https://journals.sagepub.com/doi/abs/10.1177/0972652718777056.

Agarwal. Pankaj K., & Pradhan, H. K. (2019). Mutual fund performance in changing economic conditions: Evidence from an emerging economy. Cogent Economics & Finance, 7(1). Available at: https://www.tandfonline.com/doi/full/10.1080/23322039.2019.1687072.

Amitabh, G. (2001). Mutual funds in India: A study of investment management. Finance India, 15(2), 631-637.

Arena, Marco. (2006). Does insurance market activity promote economic growth? Country study for industrial and developing countries (2006). World Bank Policy Research Working Paper No. 4098. Available at SSRN: http://ssrn.com/abstract=952070.

Deb, S. G., Banerjee, A., & Chakrabarti, B. B. (2007). Market timing and stock selection ability of mutual funds in India: An empirical investigation. Vikalpa, 32(2), 39-52. Available at: https://journals.sagepub.com/doi/10.1177/0256090920070204.

Dhar, J., & Mandal, K. (2014). Market timing abilities of Indian mutual fund managers: An empirical analysis. Decision, 41(3), 299–311. doi:10.1007/s40622-014-0036-2. Available at: https://link.springer.com/article/10.1007/s40622-014-0036-2.

Gupta, O. P., & Sehgal, S. (1998). Investment performance of mutual funds: The Indian experience. ICFAI Journal of Applied Finance, 2, 25-36.

IDBI DBR (2001a). Report on development banking in India, 1999-2000, IDBI June 19, 2001, pp. 64-65.

IDBI DBR (2001b). Report on development banking in India, 1999-2000, IDBI June 19, 2001, pp. 70-71.

IDBI DBR (2001c). Report on development banking in India, 1999-2000, IDBI June 19, 2001, pp. 75.

Kale, Jayant R., & Panchapagesan, Venkatesh. (2012). Indian mutual fund industry: Opportunities and challenges. IIMB Management Review, 24(4), 245-258. Available at: https://www.sciencedirect.com/science/article/pii/S0970389612000420.

Kumar, M. S. R. (2008). Indian insurance industry outlook in the post-reform period. Management Researcher, XV(1), 34-45.

Kumar, R. (2016). Conditional models in performance evaluation of mutual funds in India. IJTRA, 4(1), 94-101. Available at: https://www.ijtra.com/view/conditional-models-in-performance-evaluation-of-mutual-funds-in-india.pdf.

Manjit Singh, & Rohit Kumar. (2008). Indian insurance industry outlook in the post reform period. Management Researcher, XV(1), 34-45.

Prakruthi & Arabi, U. (2018). Financial performance of life insurance corporation (LIC) of India- A study. Paripex-Indian Journal of Research, 7(7), 27-28. Available at: https://www.worldwidejournals.com/paripex/fileview/July_2018_1531132820__64.pdf.

Ramanujam, V., & Bhuvaneswari A. (2015). Growth and performance of Indian mutual fund industry during past decades. International Journal of Advance Research in Computer Science and Management Studies, 3(2), 283-290. Available at: https://www.researchgate.net/publication/322820965.

Rao, D. T. (1999). Life insurance business in India: analysis of performance. Economic and Political Weekly, 34(31), 2174-2181.

Reddy, S. M. (2015). Investment pattern of life insurance industry during post reform period. Asian Journal of Research in Banking and Finance, 5(3), 132-142. Available at: https://www.researchgate.net/publication/276521141.

Reddy, V. V. N., & Reddy, S. M. (2019). Performance of life insurance corporation of India: A post-deregulation experience. International Journal of Management, Technology and Engineering, IX(II) 1782-1791. Available at: https://www.researchgate.net/publication/336892696.

Roy, B., & Deb, S. S. (2003). The conditional performance of Indian mutual funds: An empirical study. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=593723.

Roy, S., & Ghosh, S. (2010). Diversification as a measure of mutual fund performance: An empirical study of the open-ended mutual fund schemes in India. Annamalai International Journal of Business Studies & Research, 2(1), 1-15.

Roy, S. (2016). Another look in conditioning alphas on economic information: Indian evidence. Global Business Review, 17(1), 191–213. Available at: https://journals.sagepub.com/doi/abs/10.1177/0972150915610723.

Saroj Pant, & Amit Dumka. (2016). Analysis of investment pattern of LIC after Enactment of IRDA ACT 1999. Sai Om Journal of Commerce & Management, 3(11), 26-34.

Sinha, T. (2005). The Indian insurance industry: Challenges and prospects. Available at: http://ssrn.com/abstract=792166. or http://dx.doi.org/10.2139/ssrn.792166.

Sumana B. K., & Roshan K. (2016). A review of literature on life insurance in India. International Journal of Research in Finance and Marketing, 6(3), 1-12.

Sonika Chaudhary, & Priti Kiran. (2011). Life insurance industry in India-Current scenario. IJMBS, 1(3), 146-155.

Sourav Kumar Das, Samyabrata Das, & Samarpita Seth. (2021). Performance of mutual funds in India: A study with reference to select equity multi-cap funds. Management Journal for Advanced Research, 3(1), 8-14. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4384757.

Sunayna Khurana. (2013). Analysis of service quality gap in Indian life insurance industry. European Journal of Commerce and Management Research, 2(3), 41.47. Available at: https://www.researchgate.net/publication/280489518.

https://licindia.in/web/guest/history.

https://www.gicre.in/en/about-us/history-in-brief.

Report on Development Banking in India, IDBI, 1999-2000, 2000-2001.

RBI Annual Report, Various Issues from 1999-00 to 2021-22.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Pankaj Kumar

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.