The Effect of Selected Macroeconomic Factors on a Stock Market Performance in Zambia

DOI:

https://doi.org/10.5281/zenodo.10775342Keywords:

macroeconomic factors, stock market, stock exchangeAbstract

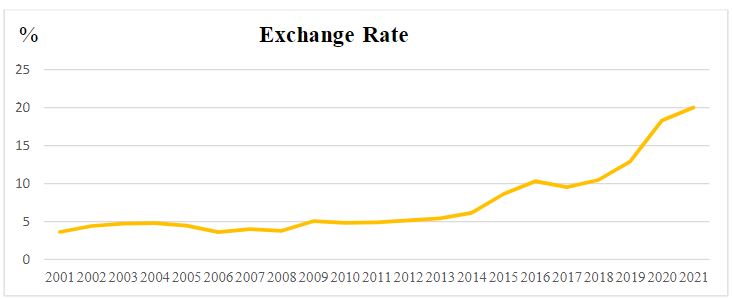

This was a study on the effect of selected macroeconomic factors on a stock market performance in Zambia. The study objectives where to determine the effect of the exchange rates on the LuSE all shares index in Zambia; to investigate the effect of inflation on the LuSE all shares index in Zambia and to establish the effect of interest rates on the LuSE all shares index in Zambia. Interest rate, inflation rate and exchange rate where the independent variables while stock market index was the dependent variable. The study targeted 24 firms listed on the Lusaka Stock Exchange. The study used secondary data which was sourced from the Bank of Zambia. The findings of the study reveal that the selected macroeconomic variables have an effect on stock market performance. This is because the study findings revealed that interest rate, inflation rate and exchange rate have a correlation with stock market index which can either be positive or negative. From the various tests and correlation models used, based on the study findings, the study concludes that selected macroeconomic factors in the country over the study period have been changing greatly. There were huge variations in the interest rates, inflation rates and exchange rates. Generally, the study concludes that interest rates, inflation rates and exchange rates influence the LuSE performance and can be used to predict the stock market performance. There was a strong and significant relationship between all the macroeconomic factors and the stock market performance. This implies that the macroeconomic environment in Zambia is a key determinant of business activities including the performance of the stock market. As a result, the study recommends that there is need for the Bank of Zambia to maintain a stable foreign currency exchange in order to attract foreign investors to the LuSE.

Downloads

References

Ajayi, A., & Olaniyan, O. (2016). Dynamic relations between macroeconomic variables and stock prices. British Journal of Economics, Management & Trade, 12(3), 1–12.

Aifuwa, H. O. (2020). Sustainability reporting and firm performance in developing climes: A review of literature. Copernican Journal of Finance & Accounting, 9(1), 9-29.

Ali, P. I., Nzotta, S. M., Akujuobi, A. B. C., & Nwaimo, C. E. (2020). Impact of macroeconomic variables on stock return volatility: Evidence from Sub-Sahara Africa. International Business and Accounting Research Journal, 4(2), 58-70.

Assagaf, A., Murwaningsari, E., Gunawan, J., & Mayangsari, S. (2019). The effect of macro-economic variables on stock return of companies that listed in stock exchange: Empirical evidence from Indonesia. International Journal of Business and Management, 14(8), 108-116.

Atanda, F. A., Asaolu, T., & Adewale, A. (2015). Macroeconomic variables and value creation in the Nigerian quoted companies. International Journal of Economics and Finance, 7(6), 252-262.

Banda, K., Hall, J. H., & Pradhan, R. P. (2019). The impact of macroeconomic variables on industrial shares listed on the Johannesburg stock exchange. Macroeconomics and Finance in Emerging Market Economies, 12(3), 270-292.

Bayar, Y., & Ceylan, I. E. (2017). The impact of macroeconomic uncertainty on firm profitability: A case of bistnon-metallic mineral products sector. Journal of Business Economics and Finance, 6(4), 318-327. http://doi.org/10.17261/Pressacademia.2017.764.

Bilson, C. M., Brailsford, T. J., & Hooper, V. J. (2001). Selecting macroeconomic variables as explanatory factors of emerging stock market returns. Pacific-Basin Finance Journal, 9(4), 401-426.

Ganda, F. (2021). The influence of growth determinants on environmental quality in Sub- Saharan Africa states. environment, Development and Sustainability, 23(5), 7117-7139.

Gatsi, J. G., & Gadzo, S. G. (2013). Firm level and macroeconomic effects on financial performance of insurance companies in Ghana. International Journal of Business Administration and Management, 3(1), 1-9. http://www.ripublication.com/ ISSN 2278- 3660.

Ghareli, S., & Mohammadi, A. (2016). A study on the effect of macroeconomic variables and firm characteristics on the quality of financial reporting of listed firms in Tehran stock exchange. Journal of Fundamental and Applied Sciences, 8(2), 1777-1797.

Gikombo, E. M., & Mbugua, D. (2018). Effect of select macroeconomic variables on performance of listed commercial banks in Kenya. International Academic Journal of Economics and Finance, 3(1), 80-109.

Haider, S., Anjum, N., Sufyan, M., Khan, F., & Ullah, A. (2018). Impact of macroeconomic variables on financial performance: Evidence of automobile assembling sector of Pakistan stock exchange. Sarhad Journal of Management Sciences, 4(2), 212-213.

Hasan, M. B., Islam, S. N., & Wahid, A. N. (2018). The effect of macroeconomic variables on the performance of non-life insurance companies in Bangladesh. Indian Economic Review, 53(1), 369-383.

Hunjra, A. I., Chani, D., Irfan, M., Javed, S., Naeem, S., & Ijaz, M. S. (2014). Impact of micro economic variables on firms’ performance. International Journal of Economics and Empirical Research, 2(2), 65-73. https://mpra.ub.uni-muenchen.de/60792/.

Hunjra, A. I., Chani, D., Irfan, M., Ijaz, M. S., & Farooq, M. (2014). The impact of macroeconomic variables on stock prices in Pakistan. International Journal of Economics and Empirical Research, 2(1), 13-21.

Huy, D. T. N. (2020). Risk management via measuring impacts of micro and macro-economic factors on financial firm stock price—A case of mitsubishi ufa in Japan. Economics, 8(1), 1-14.

Ifeacho, C., & Ngalawa, H. (2014). Performance of the South African banking sector since 1994. Journal of applied Business Research (JABR), 30(4), 1183-1196.

IMF. (2019). Zambia: Country economic memorandum. International Monetary Fund.

Irungu, S. M., & Muturi, W. (2015). Impact of macroeconomic variables on performance of firms quoted in the energy and allied sector in the Nairobi securities exchange. International Journal of Education and Research, 3(10), 321-336.

Ismail, N., Ishak, I., Manaf, N. A., & Husin, M. M. (2018). Macroeconomic factors affecting performance of insurance companies in Malaysia. Academy of Accounting and Financial Studies Journal, 22, 1-5.

Issah, M., & Antwi, S. (2017). Role of macroeconomic variables on firms’ performance: Evidence from the UK. Cogent Economics & Finance, 5(1), 1405581.

Kanwal, S., & Nadeem, M. (2013). The impact of macroeconomic variables on the profitability of listed commercial banks in Pakistan. European journal of business and social sciences, 2(9), 186-201.

Kargbo, J. M. (2007). The effects of macroeconomic factors on South African agriculture. Applied Economics, 39(17), 2211-2230.

Kholisoh, S. N., & Dwiarti, R. (2020). The analysis of fundamental variables and macro-economic variables in predicting financial distress. Management Analysis Journal, 9(1), 81-90.

Kisten, T. (2020). Macroeconomic implications of uncertainty in South Africa. South African Journal of Economic and Management Sciences, 23(1), 1-15.

Kitatia, E., Zablonb, E., & Maithyac, H. (2015). Effect of macroeconomic variables on stock market prices for the companies quoted on the nairobi securities exchange in Kenya. International Journal of Sciences: Basic and Applied Research, 21(2), 235-263.

Kpanie, A. F., & Esumanba, S. V. (2014). Relationship between stock market performance and macroeconomic variables in Ghana. Journal Issues ISSN, 2350, 157X.

Larina, L.B., Postnikova, D.D., Ageeva, O.A. & Haabazoka, L. (2021). The scientific and methodological approach to provision and evaluation of the digital economy’s global competitiveness. Popkova EG, Krivtsov A., Bogoviz AV The Institutional Foundations of the Digital Economy in the 21st Century. Berlin, Boston: De Gruyter, pp.173-182.

MoF. (2021). Economic insight: January; monthly economic indicators. Ministry of Finance.

Mohamed, I. A., & Ahmed, S. (2018). The effects of macroeconomic variables on stock returns in the Jordanian stock market. Global Journal of Management and Business, 5(2), 087-093.

Mwanaumo, E.M., Chisumbe, S., Mbewe, N., Mambwe, M., & Haabazoka, L. (2020). Suitable infrastructure projects for public private partnerships in Zambia. In: Popkova, E.G., Sergi, B.S., Haabazoka, L., Ragulina, J.V. (eds) Supporting Inclusive Growth and Sustainable Development in Africa - Volume I. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-41979-0_19.

Naka, A., Mukherjee, T., & Tufte, D. (1998). Macroeconomic variables and the performance of the Indian stock market. https://scholarworks.uno.edu/econ_wp/15 Ministry of Finance, 2020 Annual Economic Report.

Ndlovu, C., & Alagidede, P. (2018). Industry structure, macroeconomic fundamentals and return on equity: Evidence from emerging market economies. International Journal of Emerging Markets. 2(9), 41-57

Okafor, H. O. (2012). Do domestic macroeconomic variables matter for foreign direct investment inflow in Nigeria. Research Journal of Finance and Accounting, 3(9), 55-67.

Osamwonyi, I. O., & Michael, C. I. (2014). The impact of macroeconomic variables on the profitability of listed commercial banks in Nigeria. European Journal of Accounting Auditing and Finance Research, 2(10), 85-95.

Oseni, I. O., & Nwosa, P. I. (2011). Stock market volatility and macroeconomic variables volatility in Nigeria: An exponential GARCH approach. Journal of Economics and Sustainable Development, 2(10), 28-42.

Oxelheim, L. (2003). Macroeconomic variables and corporate performance. Financial Analysts Journal, 59(4), 36-50.

Pacini, K., Mayer, P., Attar, S., & Azam, J. (2017). Macroeconomic factors and firm performance in The United Kingdom. Journal of Smart Economic Growth, 2(3), 1-11.

Pacini, K., Berg, D., Tischer, T., Mayer, P., Azam, J., & Johnson, J. (2018). Macroeconomic factors dynamics and firm performance in the United Kingdom. International Journal of Latest Trends in Finance & Economic Sciences, 8(2), 1393-1398.

Rahman, M. M. (2019). The relationship between macroeconomic variables and stock exchange prices: A case study in Dhaka stock exchange (DSE) in Bangladesh. Financial Markets, Institutions and Risks, 3(3), 2521-1250. ISSN (online) – 2521-1242 ISSN (print) –2521-1250.

R Reddy, V., & Nagendra S, N. S. (2019). Impact of macroeconomic factors on Indian stock market-a research of bse sectoral indices. International Journal of Recent Technology and Engineering, 8(257), 1-6.

Rolle, J. A., Javed, B., & Herani, G. M. (2020). Micro and macroeconomic determinants of profitability of conventional banks and stock performance using Tobin’s Q ratio: Evidence from the banking sector of Pakistan. International Journal of Business and Economic Development (IJBED), 8(2).

Romus, M., Anita, R., Abdillah, M. R., & Zakaria, N. B. (2020, April). Selected firms environmental variables: Macroeconomic variables, performance and dividend policy analysis. In: IOP Conference Series: Earth and Environmental Science 469(1), 012047.

Pham, D. C., Do, T. N. A., Doan, T. N., Nguyen, T. X. H., & Pham, T. K. Y. (2021). The impact of sustainability practices on financial performance: Empirical evidence from Sweden. Cogent Business & Management, 8(1), 1912526.

Sasidharan, S., Ranjith, V., & Prabhuram, S. (2020). Micro-and macro-level factors determining financial performance of uae insurance companies. The Journal of Asian Finance, Economics, and Business, 7(12), 909-917.

Setshedi, C., & Mosikari, T. J. (2019). Empirical analysis of macroeconomic variables towards agricul-tural productivity in South Africa. Ital-ian Review of Agricultural Economics, 74(2), 3-15

Shafana, M. A. C. N. (2014). Macroeconomic variables effect on financial sector performance in emerging sri lankan stock market. International Journal of Science and Research, 3(10), 227-231.

Soukhakian, I., & Khodakarami, M. (2019). Working capital management, firm performance and macroeconomic factors: Evidence from Iran. Cogent Business & Management, 6(1), 1684227.

Ullah, G. M. W., Islam, A., Alam, M. S., & Khan, M. K. (2017). Effect of macroeconomic variables on stock market performance of SAARC countries. Asian Economic and Financial Review, 7(8), 770.

Verma, R. K., & Bansal, R. (2021). Impact of macroeconomic variables on the performance of stock exchange: a systematic review. International Journal of Emerging Markets. https://doi.org/10.1108/IJOEM-11-2019-0993.

Willy, O. C. O. (2012). Macroeconomic fluctuations effects on the financial performance of listed manufacturing firms in Kenya. International Journal of Social Sciences 21(1) 26- 40. ISSN 2305 – 4557.

Yakub, A. R. A., Hishamuddin, M., Ali, K., Achu, R. B. A. J., & Folake, A. F. (2020). The effect of adopting micro and macroeconomic variables on real estate price prediction models using ANN: A Systematic Literature. Journal of Critical Reviews, 7(11), 492- 498.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Chikumbi Chola

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.