Value-Added Tax Monopoly: A Threat to Low Revenue-Generating States in Nigeria

DOI:

https://doi.org/10.5281/zenodo.10616907Keywords:

tax, value added tax, low revenue, revenue generation, nigeriaAbstract

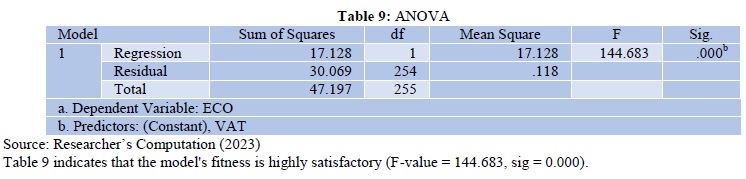

This paper examines the effect of value-added tax monopoly by some states on low revenue-generating states. An exploratory/survey approach was adapted. Employment, revenue generation, and economic development were used as proxies to measure the monopolistic effect of value-added tax on low revenue-generating states. Primary source of data collection was employed through a closed-end questionnaire. The population of the study stand at 273 respondents drawn from Borno, Gombe, and Yobe state, with a sample size of 256 using stratified sampling technique. Linear Regression was employed to analyze the data with the help of SPSS version 27. Findings show that monopoly of value-added tax by states will negatively and significantly affect employment, revenue generation, and economic development of other states. The study concluded that value-added tax revenues should be generated for redistribution to states and local governments in Nigeria to argument their internally generated revenue as this will enhance growth and economic development. It was recommended by the study that resources should be redistributed equitable and fairly by the federal government so as to reduce persistent friction in the revenue allocation.

Downloads

References

Abdul-Rahman O. A., Joshua A. R., & Ayorinde A. O. (2013). Assessment of value added tax and its effects on revenue generation in Nigeria. International Journal of Business and Social Science, 4(1), 220-225.

Adebanjo, A. (2021). Unending vat war under Nigeria’s federal constitution: Exploring the contours of Nigeria’s fiscal federalism and sociology. Available at: https://ssrn.com/abstract=3933022.

Adegbie, F.F., Nwaobia, A.N., & Osinowo, O. (2020). Non-oil tax revenue on economic growth and development in Nigeria. European Journal of Business and Management Research, 5(3), 1-10.

Adeoti, T. (2021, September 08). Retrieved from: https://www.proshareng.com>news>FG-vs-State-VAT.

Akinrinola O. O., & Oreoluwa B. (2021). Effect of the tax system on the economic development of a nation: Nigeria experience. Journal of Advanced Research in Business Management and Accounting, 7(11), 24-34.

Akitoby, B., Baum, A., Hackney, C., Harrison, O., Primus, K., & Salins, V. (2020). Tax revenue mobilization episodes in countries. Policy Design and Practice, 3(1). Available at: https://doi.org/10.1080/25741292.2019.1685729.

Alshujairi, M. H. (2014). Government accounting system reform and the adoption of IPSAS in Iraq. Research journal of finance and accounting, 5(6).

Aminu, Y. U., Dogara, M., & Mohammed, B. M. (2020). Impact of value added tax (Vat) on revenue generation by federal inland revenue service in Nigeria (2001 – 2017). Hallmark University Journal of Management and Social Sciences (HUJMSS), 30-39.

Bank-Ola, R. F. (2021). Value added tax administration and economic growth in Nigeria. Global Journal of Education, Humanities and Management Sciences (GOJEHMS), 3(1), 88-106.

Bo G., Jing M., & Zheng W. (2021). The employment and wage effects of export VAT rebates: evidence from China. Review of World Economics. https://doi.org/10.1007/s10290-020-00400-3.

Collins C., & Peter Z. (2019). The effect of value added tax on government total revenue; Evidence from Nigeria: 1994-2018. FUW Journal of Accounting and Finance (FUWJAF), 1(1), 89-101.

Caleb A. A., Daniel O. D., Samuel A. O., & Abiodun S. O. (2019). The value added tax (VAT) administration in Nigeria and the practice of estate surveying and valuation. Covenant Journal of Business & Social Sciences (CJBSS) 9(1), 45-54.

Edojor, C. O., Favour, O. A., Raphael, I. A. A., & Gina, O. (2019). Value added tax and revenue generation in Nigeria: An empirical analysis. Journal of Taxation and Economic Development, 18(1), 59-71.

Eiya O, & Osazuwa N. P. (2017). Taxes and unemployment in Nigeria. International Accounting and Taxation Research. http://hdl.handle.net/11159/4362.

Emmanuel, E. C. (2021). Effect of value added tax reform on gross domestic product in Nigeria. Research Journal of Management Practice, 1(8), 72-82.

Enemuo U. C., Chigozie P. M., & Obianuju A. O. (2021). Taxation and Nigerian economy: Benchmarking value added tax 2000 – 2020. International Journal of Business And Management Research, 191-208.

Ewa, U. E. (2021). Appraisal of self-assessment tax policy in Nigeria. European Journal of Business and Management Research. doi:10.24018/ejbmr.2021.6.1.693.

Folorunsho, A. (2021). VAT - Ag. Rivers V. FIRS And pending suit on stamp duty & AG Abia state & 35 Ors V. AG federation examined. Review of the Case Facts and Lessons for Tax Authorities, 1-12.

Hakim, T. A. (2020). Direct versus indirect taxes: impact on economic growth and total tax revenue. International Journal of Financial Research, 11(2), 146-153. doi:10.5430/ijfr.v11n2p146.

Igwebuike, A. E. (2020). The genesis and development of value added tax administration: Case study of Nigeria. International Journal of Academic Research in Accounting Finance and Management Sciences, 14-30.

Israel, O. (2015). Tax reforms in Nigeria: Case for Value Added Tax (VAT). An International Multidisciplinary Journal, Ethiopia, 9(4), 227-287. http://dx.doi.org/10.4314/afrrev.v9i4.21.

Kaisa A., Mika H., & Jukka P. (2018). The effects of the value-added tax on revenue and inequality. The Journal of Development Studies. https://doi.org/10.1080/00220388.2017.1400015.

Kaka, E. J., & Ado, A. B. (2020). An investigation of the link between indirect tax, oil receipt, and debt on foreign reserve in Nigeria. Journal of Contemporary Accounting, 2(3), 119-128.

Kristjánsdóttir, H. (2016). Tax on tourism in Europe: Does higher value-added tax (VAT) impact tourism demand in Europe. Current Issues in Tourism. https://doi.org/10.1080/13683500.2020.1734550.

Kristjánsdóttir H., Guðlaugsson T. O., Guðmundsdóttir S., & Aðalsteinsson G. D. (2017). Hofstede national culture and international trade. Applied Economics, 49(57), 5792–5801. https://doi.org/10.1080/00036846.2017.1343446.

Kristjánsdóttir, H. (2019). Tourism in a remote Nordic region: Vat, Internet, oil, english, distance, hofstede, and christianity. Cogent Social Sciences. https://doi.org/10.1080/23311886.2019.1709346.

Kubickova, M. (2019). The impact of government policies on destination competitiveness in developing economies. Current Issues in Tourism, 22(6), 619–642. https://doi.org/10.1080/13683500.2017.1296416.

Liu Q., & Lu Y. (2015). Firm investment and exporting: Evidence from China’s value-added tax reform. Journal of International Economics, 97(2), 392–403.

Monica A. O., & Kazeem F. (2022). The effect of value-added tax on economic growth of Nigeria. African Journal of Economic Review, 10(1), 158-169.

Mukolu, M.O, & Ogodor, B. N. (2021). The effect of value added tax on economic growth of Nigeria. IAR Journal of Business Management. https://www.iarconsortium.org/journal-info/IARJBM.

Obaretin, O., & Uwaifo F. N. (2020). Value added tax and economic development in Nigeria. International Accounting and Taxation Research, 148-157.

Oluseyi E. S., & Mujeeb O. A. (2019). Influence of value added tax on economic development (The Nigeria perspective). Journal of Accounting and Management, 9(3) 35-43.

Omesi, I., & Ihenyen, C. J. (2020). Value added tax and Nigerian economy: A pre & post reform analysis. Sustainability Accounting, Management and Policy Journal, 7(3), 9-18.

Omodero, C. O. (2020). The consequences of indirect taxation on consumption in Nigeria. Journal of Open Innovation: Technology, Market, and Complexity, 1-13.

Omondi B., O. (2019). An empirical analysis of value added tax on economic growth, evidence from Kenya data set. Journal of Economics, Management, and Trade, 22(3), 1-14. doi:10.9734/JEMT/2019/46167.

Onoh U. A., Okafor, M. C., Efanga U. O., & Ikwuagwu H. C. (2021). Tax policies and its impact on economic growth in Nigeria. Global Academic Journal of Economics and Business, 3(2), 49-59. doi:10.36348/gajeb.2021.v03i02.001.

Oraka A. O., Theophilus O. O., & Raymond A. E. (2017). Effect of value added tax on the Nigerian economy. European Academic Research, 1185-1223.

Oyedele, T. (2021). How to fix Nigeria's broken vat system. Header Image Credit: icirnigeria.

Sanni, J. H. (2017). The benefits and challenges of adopting the international public sector accounting standards in foreign charities in Ethiopia. A Thesis Submitted to Department of Management College of Business and Economics, Addis Ababa University.

Udezo N. O., & Onuora JKJ. (2021). Effect of tax reforms on revenue performance in Nigeria, International Journal of Innovative Finance and Economics Research 9(1), 118-130.

Yan D., Mengkai Y., Jing L., & Yunong L. (2020). The stagnant export upgrading in northeast China: Evidence from value-added tax reform. China & World Economy, 28(4), 101–126.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Yusuf Aliyu, Usman Alhaji Audu

This work is licensed under a Creative Commons Attribution 4.0 International License.

Research Articles in 'Management Journal for Advanced Research' are Open Access articles published under the Creative Commons CC BY License Creative Commons Attribution 4.0 International License http://creativecommons.org/licenses/by/4.0/. This license allows you to share – copy and redistribute the material in any medium or format. Adapt – remix, transform, and build upon the material for any purpose, even commercially.